About Us

Company Summary

AMJ Capital Partners, LLC (https://www.amjcapitalpartners.com) is structured as a Limited Liability Corporation (LLC). It is our investor relations- management company- dedicated to finding, creating and nurturing strategic relationships with investment partners who fund and/or participate in the acquisition process of our projects; and motivated to help AMJCP grow. AMJCP provides structure, marketing capabilities, and a clear exit strategy on carefully selected value-add/stabilized/ CRE projects.

Our business model employs a team approach, utilizing highly seasoned, successful CRE professionals [Board of Advisors] with the experience, creditability, reputation, connections and innovation required for market leadership.

AMJCP, LLC is organized for successful delivery of value-added services and is comprised of the following business groups-Special Purpose Entities [ SPEs]:

Associated entities are actively managed by Andrew Marshall and operate as shown and described below.

AMJ Enterprises, LLC: Multifamily| Apartments Consulting| Investment Services: Capital Raising

Maximum Apartment Profits: www.maximumapartmentprofits.com: In-House Multifamily Project Management: Website under construction

Landstar Apartments, LLC: Wholesaling: Small Apartments: Residential Properties: BUY & HOLD|FIX & FLIP

Landstar Enterprises, LLC: www.landstarenterprises.com:Internet Marketing: Social Media Platform Integration: Website under construction

Management

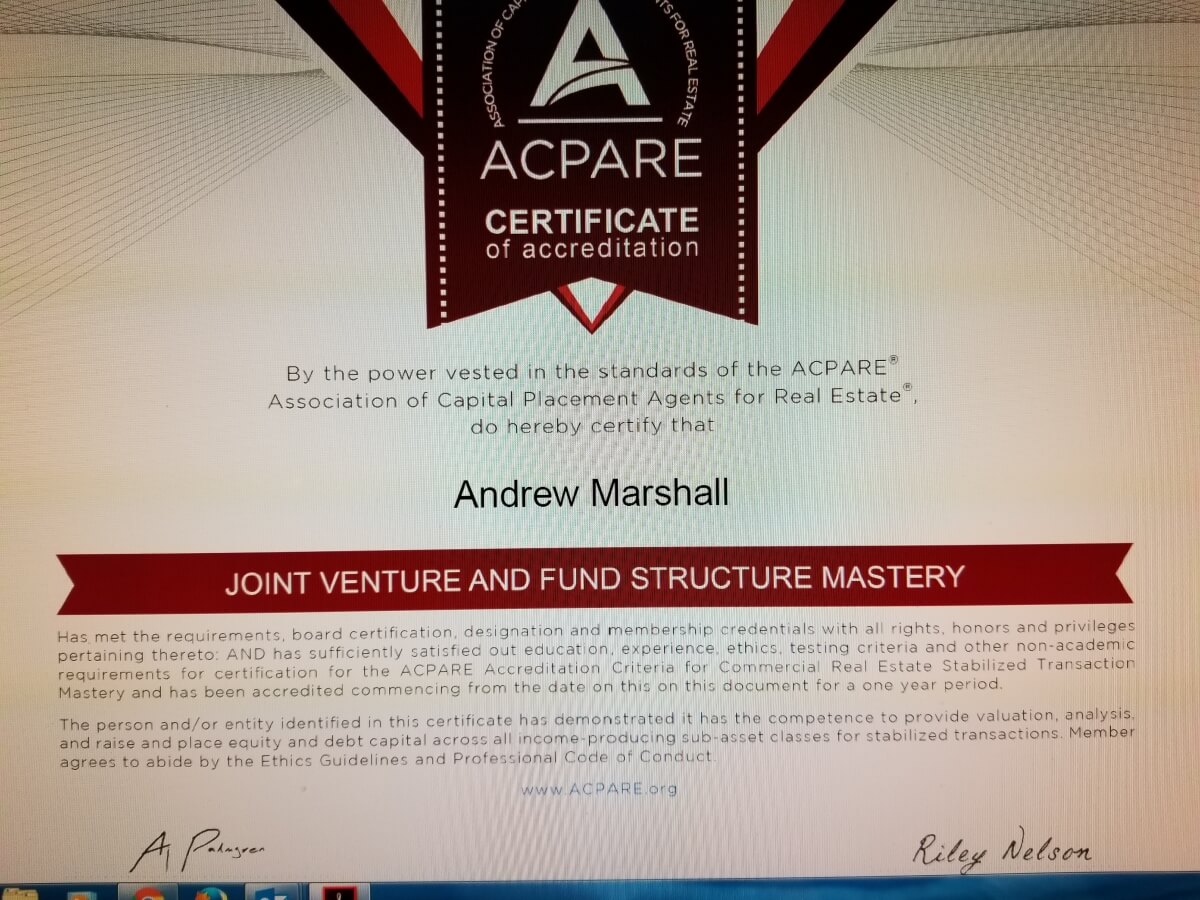

AMJCP is led by Andrew Marshall: Managing Director with diversified and specialized commercial multifamily-capital raising-internet marketing/ social media expertise. Andrew brings advanced multifamily apartment training and investing expertise including research, valuations, acquisition, and disposition of multifamily assets as a CRE entrepreneur-“deal strategist and “deal profiteer”. Andrew’s multifaceted roles include “Bird-Dog” capacities for REITs- Hedge Funds-JV opportunities that cover all classes of apartments (A-B-C) and all project sizes and levels of complexity. Andrew has assembled an exceptional strong and talented Board of Advisors with proven track records as “transactional deal makers”- ability to raise private capital funding- successfully execute market-driven CRE business plans and strategies for both multifamily stabilized and value-add property acquisitions.

Corporate Structure | AMJCP, LLC

Andrew Marshall – Owner/Principal

Andrew Marshall brings 10 years of commercial real estate-multifamily apartment investments – capital raising – deal structuring – internet marketing expertise to his role as Managing Director of AMJ Capital Partners.

AMJCP has established a strong network of cash buyers, strategic business partners-broker networks-focused on “off market” multifamily acquisitions. Andrew’s Entrepreneurial and broad-based business experience combined with advanced CRE investment skills are client-centric and focused on providing investor opportunities for capitalizing on profitable, high-yield, cash-flowing commercial real estate investments.

AMJCP Management Team is comprised of a “Who’s Who” of high-profile, active investors/business owners with proven track records of distinguished success and highest levels of CRE investments expertise.

Board of Advisors

Our investors receive our team’s 90 + years of combined experience in Commercial Real Estate Investing and Acquisitions, Deal Structuring & Analysis, Underwriting, Asset Disposition, Capital Raising Expertise.

AMJCP is committed to a risk aversion methodology and protecting our clients CRE investments! The better you do, the better we do. This is a designed alliance in which we work together to achieve the most desirable outcomes and solid proven results for our investors every time.

Gene Trowbridge, Esq., CCIM, CDEI: Partner at Trowbridge Taylor Sidoti LLP

www.CrowdfundingLawyers.net

Gene Trowbridge brings over 30 years of commercial and investment real estate experience concentrating in syndication, legal and education. His specialties include real estate syndication, private placement memorandum’s, commercial education & investing consulting as well as being the best-selling author of “It’s a Whole New Business” 2nd Edition: For Group Sponsors of Investment Real Estate.

It is the definitive and essential text on creating and sponsoring real estate investment groups. He received the Robert L. Ward Instructor of the Year Award in 2002. Gene was the 2005 recipient of the Victor L. Lyon Distinguished Service Award of the CCIM Institute, recognizing his long-standing and exceptional service to the commercial investment real estate industry.

Susan Lassiter-Lyons: Commercial Real Estate Investments-Multifamily-Entrepreneur- Financial Publisher- Internet Marketer

https://theincomeinvestors.com

https://www.linkedin.com/in/susanlassiterlyons/

Susan has been involved in real estate since 1994 and has since raised $26.2 million in private money from debt and equity partners in addition to teaching more than 10,000 students who have cumulatively raised hundreds of millions in private money. She is an Amazon Best-Selling Author of “Getting the Money: The Simple System for Getting Private Money for Your Real Estate Deals.

Richard “The Professor” Odyssey, Ph.D.

http://www.investorwealthnetwork.com

https://www.linkedin.com/in/richardodessey

Richard “The Professor” Odyssey: Highly acclaimed Private Lending Insider Training Program with proven methodology to Raise Private Capital; it is specifically designed to work in Today’s Economy with investors who are much more selective of how and where they invest their capital. Richard helped start a Biotech company which raised $10 million in funding.

For the past 20 years, Richard has been investing in Real Estate and closed almost every type of real estate deal imaginable, including short sales, flips, lease options, owner financing, rehabilitation, new construction and more on both single- and multi-family properties. Because he is also a Private Investor as well as a Real Estate Entrepreneur, Richard has intimate knowledge of both sides of the private investing equation.

Peter Harris, “The Apartment Consultant”

Joint Venture multifamily value-add opportunities with AMJ Capital Partners

www.theapartmentconsultant.com/home

Co-Author Commercial Real Estate Investing for Dummies Rated #1 in the industry

AMJ Capital Partners is appreciative of your thoughtful consideration of our multifamily apartment investment services. Our commitment to excellence with an emphasis on adding value delivered with accountability and integrity is a mandate for our firm. We consider each investor partners unique investment criteria requiring long-term stewardship of their capital investment as our highest priority. We continue to move forward building collaborative and nurtured partnership relationships. We’re confident that your investment can best be served by private partnerships that can offer the full range of value-added investment services delivering higher performance yields: