Welcome To

AMJ CAPITAL PARTNERS, LLC

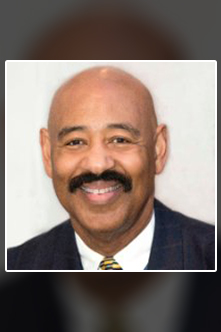

Andrew Marshall-Managing Director | MULTIFAMILY APARTMENTS ADVISORY SERVICES

| Real Estate Wealth Building- Entrepreneur | Maximize Profits | Reduce Risks

AMJCP invests private capital in commercial real estate investment opportunities and is uniquely positioned to help clients identify, structure, and place capital in only the highest-potential-for-profit multifamily assets. Our clients include institutions and sophisticated high net worth investors. We provide valued insights into the complex, hyper competitive Orange County apartment market including all facets of apartment investment and ownership.

Who We Are

What We Do

AMJ Capital Partners Multifamily Acquisitions

AMJ Capital Partners, LLC is an entrepreneurial-driven, commercial real estate investment advisory services firm based in Newport Beach, CA specializing in multifamily apartment acquisitions. The firm’s capital preservation and apartment “repositioning” investment strategies focus on identifying client wealth building opportunities that maximize profits and minimize risk. AMJCP investment projects involve B and C class (Core-plus/high-rise, garden) apartment properties. In recent years, there has been a significant increase in the acquisition of Class B and C apartments, intensifying the interest of local investors and larger institutional players.

We also engage in Value-Added investments and Joint Venture deal structures for Class A /B apartment properties in primary and high yield sub-market MSA’s.

As investors attempt to create deal flow and pour capital into a possible overheated apartment market the search for higher yield and greater returns continues at an accelerated pace.

Faced with the challenges of rising construction costs and the advancing threat of oversupply, active investors are adjusting their investment strategies accordingly to find and ink the best values in Class B and C assets.

AMJCP Value-add apartment investments are oriented solely towards the acquisition and management of a specified multifamily asset, which include the following considerations:

- The current business climate- market cycle-demographics

- Strategic investment: Capital preservation with minimum risks and greater yields. Value-Add Investment Strategy: Re-development (real estate acquisition for renovation, future repairs and resale at a higher price)

- Value Add opportunity can earn higher yields by channeling investor capital into emerging markets, repositioned to sell at a high price

- Mid-to-long term investment (at least five years) to capitalize on value creation and appreciation. The project earns profits that are distributed among investors at exit and fund liquidation

- Fund manager purchases property with investor capital and manages project costs-project status updates

The firm is guided by and committed to three key principles that drive the organization to understand our client’s unique investment challenges: embracing Knowledge, Vision, Integrity to help the firm build valuable long-term relationships with investor-clients & strategic business partners. These values commit the firm to achieving results that exceed clients and investment partner’s expectations.

Our mission is to help individual investors create wealth and positive cash flow through lucrative, high return, low-risk commercial real estate investments.

[fc id=’1′][/fc]

HOW WE CAN HELP

Our goal is to help clients-investment partners pursue apartment investments where we can control the events necessary to create value and minimize downside risk through the appropriate acquisition strategy and capital structure. We have the Team and the tools to successfully execute targeted “deal sourcing” opportunities for “Off-Market” Investment Deals that provide meaningful cash flow and maximum profits.

Please let Mr. Marshall know how he may help boost your income by investing in highly profitable commercial real estate income properties.